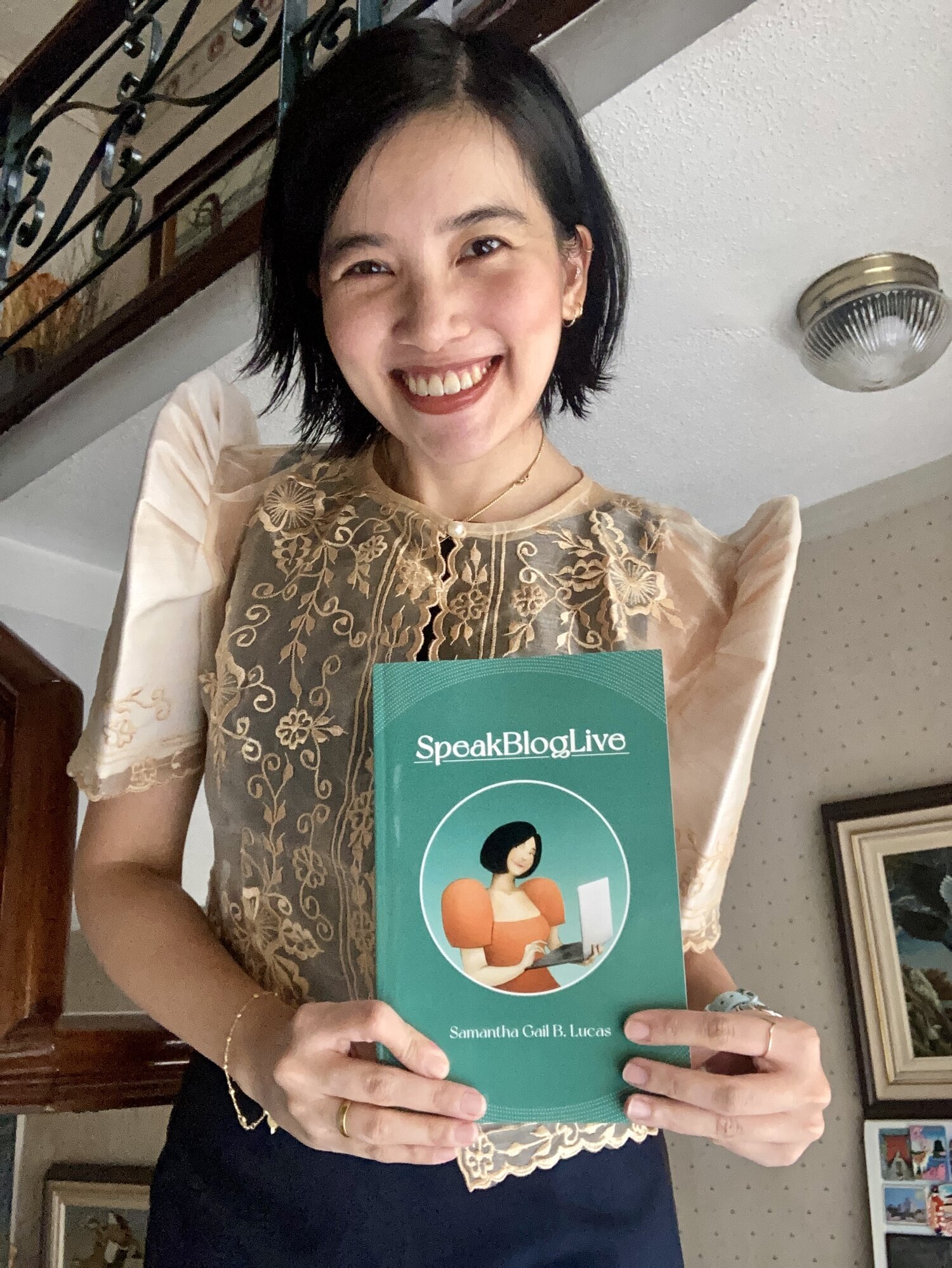

Some of my books are now available on @bookshop_org 📖 Please continue buying my books on Amazon, Google Play, and via this link. 📕 NEVER GIVE UP ON YOUR DREAMS!📚 #amazonauthor #authorlife @ukiyotopublishinghouse

Folk-pop artist syd hartha links up with hip-hop sensation kiyo on new single “3:15”

Acclaimed singer-songwriter syd hartha puts her eclecticism on full display with the release of her new single "3:15"—out today via Sony Music Entertainment.

The song finds the young, multi-talented artist collaborating for the first time with hip-hop star kiyo while expressing her complicated feelings towards someone who isn't perfect by any means but is certainly important in her life.

"3:15 is about how someone feels wrong but feels so good at the same time," explains the folk-pop artist. "I always try to convince myself that someone or something won’t always be good to me, but for some reason, I end up giving in."

The title of the track was derived from the coincidental reflections that happen during the dark, witching hours of the morning when one gets stirred from slumber and wakes up searching profusely for answers and signs.

The ayaw act adds, "It was supposed to just be temporary, until I realized that the title shares a connection with the lyrics: that specific time can also symbolize trying to make the most out of the dark."

For his part, Filipino rapper/producer kiyo drops some smooth, delicate verses that complement the track’s honest depiction of fallibility, which to some extent, mirrors the moments when a narrative becomes looser and moodier as it reaches the lateness of the hour. As kiyo puts it, "anino sa paligid, may gustong sabihin / dami ng mga mata, bakit ‘di marinig" is a line that keeps one awake, with complicated feelings of desire and danger crawling in the same sentence.

The release of "3:15" also comes with a music videohelmed by Raliug of Lunchbox Productions, with a concept by Pau Tiu. According to the filmmaker, the visual material encapsulates the perfect visualization of what the song is about: basking in the comforts of one’s safe space, which is considered a place where "emotions, including fear and shame, are present and always welcome."

"3:15" will be part of syd hartha’s upcoming new EP, which will be produced by Brian Lotho. Combining folk and stripped-down elements with contemporary flair, syd wants to assert her creative agency by exploring specific moods per song, and offering a more introspective, personal approach to songwriting.

syd hartha’s "3:15" is out now on all digital music platforms worldwide via Sony Music Entertainment.Watch the music video here.

Source: Nyou

ADB, Wabag Sign $25 Million Debt Facility to Support Sanitation and Water Security in India

NEW DELHI, INDIA (25 November 2022) — The Asian Development Bank (ADB) signed a $25 million debt facility with VA Tech Wabag Limited (Wabag) to support sanitation and water security through the development of new sewage treatment plants in India.

The financing will be used for long-term capital requirements for engineering, procurement, and construction, and the subsequent operation and maintenance of the sewage treatment plants. ADB will also provide technical assistance of up to $35,000 to enhance Wabag’s capacity to assess and mitigate environmental and social risks for future projects.

“The disposal of wastewater without proper treatment has put significant pressure on India’s already scarce water resources and the quality of those resources,” said ADB’s Private Sector Operations Department Director General Suzanne Gaboury. “This project is ADB’s first private sector financing in India’s water sector and will help to crowd in urgently needed international and domestic financing for the sector to ease water stress as demand increases.”

India is facing severe water stress, with demand expected to reach double the available water supply by 2030. Less than 30% of the water released back into rivers is treated, rendering about one-third of river water unfit for human consumption. Private water companies face difficulties in raising long-term working capital financing due to perceived high risks and low interest among domestic financing institutions, as the sector presents limited opportunities for profit.

“This is a proud moment for Wabag as we add another feather to our cap with this strategic funding from ADB that validates our mission and focus on clean, green, and sustainable water technologies,” said Wabag’s Managing Director and Group CEO Rajiv Mittal. “We are fully aligned with ADB on the need to increase interventions in India’s water sector.”

Wabag is a leading player in India's water industry, with expertise spanning almost a century. Wabag offers a complete range of technologies and services for total water solutions in both municipal and industrial sectors. It has over 1,600 water professionals spread over 25 countries on 4 continents, as well as research and development centers in Austria, India, and Switzerland.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

Source: ADB

BREAKOUT STAR NICKY YOURE SHARES INFECTIOUS NEW SONG👀 “EYES ON YOU” 👀

WATCH THE OFFICIAL VIDEO HERE

Today, 23-year-old singer/songwriter Nicky Youre has released his new song “Eyes On You.” The infectious track finds Nicky describing what it feels like to be completely infatuated with someone at first glance. Listen HERE.

“Eyes On You” arrives alongside a camp-style official video that follows an apprehensive Nicky as he cat-sits for a neighbor and, in the end, wins the hearts of the kitten and its owner. Directed by Vision Kid, the visual made its broadcast premiere on MTV Live, MTVU, MTV Biggest Pop and on the Paramount Times Square billboards. Watch HERE.

In speaking about “Eyes On You,” Nicky says: "I wrote this song after a special person in my life moved to California. We were finally in the same state, and it felt so good to be close to them. The weekend before I wrote it, I had gone to a country concert and was inspired by how fun and energetic country songs can be, as well as how full they feel live. I wanted to try to capture those feelings with this song. The combination of those two events was enough for me to write a fun love song you can sing in your car or scream along with all of your friends at a concert."

“Eyes On You” follows Nicky’s summer smash hit “Sunroof.” Tallying over 650M streams to date, the track spent 11 consecutive weeks in the Top 10 on Billboard’s Hot 100 (peaked at #4). The success of “Sunroof” also earned Nicky his first nomination at the 2022 MTV VMA’s for ‘Song of the Summer’ and saw the star make his television debut on The TODAY Show. With multiple weeks spent atop Pop and Hot AC radio, Nicky Youre will join the Jingle Ball circuit starting November 29 in Fort Worth, TX with performances in New York, Los Angeles, Philadelphia and more.

Stay tuned for more from Nicky Youre coming soon!

About Nicky Youre:

Harnessing the infectious energy of sticky melodies and relatable lyrics, rising star Nicky Youre, is putting smiles on fans' faces one song at a time. The Indie pop, southern California native, is creating a body of work that is sure to be a staple on people’s playlists, as its inherent feel-good vibes uplift fans and stick with them throughout their day.

Taking inspiration from Dominic Fike, Tai Verdes, Jeremy Zucker, Alexander 23, blackbear and more, Youre’s tracks start with the most powerful aspect of his music, the undoubtedly catchy melodies. “My best songs come from humming melodies that pop into my head out of the blue, often without a beat. I try to fill the melody with words and visualize the energy or the type of beat that would go well with it. From there I work with a producer to help bring the vision to life and the rest just comes together naturally.”

Signed to Columbia Records in partnership with Thirty Knots Records, the young up-and-coming star has made quite the splash and is looking to leave his mark as he gears up to release “Eyes On You” on November 18.

Source: Sony Music Philippines

ADB, Bank of Georgia Sign Milestone Risk Sharing Agreement for Supply Chain Financing

TBLISI, GEORGIA (24 November 2022) — The Asian Development Bank (ADB) and the Bank of Georgia (BOG) have signed a risk-sharing agreement to promote supply chain finance in Georgia.

Through the agreement, the first of its kind for ADB, the BOG and ADB’s Trade and Supply Chain Finance Program (TSCFP) will share corporate risk for supply chain transactions on a 50%-50% basis. The agreement is the culmination of 2 years of technical assistance provided by TSCFP to BOG.

“This agreement builds on our trade finance partnership with BOG that started in 2011 and will be catalytic in developing supply chain finance in the region,“ said TSCFP Head Steven Beck. “By promoting supply chain finance with our partner banks, we help small and medium-sized businesses in developing Asia to participate in global supply chains, spur economic growth, and contribute to job creation.”

Supply chain finance provides working capital to suppliers including small and medium-sized companies (SMEs) by leveraging their relationships with larger corporates. ADB estimates the gap between demand for trade finance and the money available is at least $2 trillion, with SMEs the worst affected. ADB’s TSCFP provides training and other technical assistance to banks across developing Asia to bring them up to speed on international best practices for the provision of supply chain finance.

“SMEs are especially important for the Bank of Georgia, and this agreement aims to further strengthen them and help them to explore new markets,” said Bank of Georgia’s Head of Small and Medium Business Department Zurab Masurashvili.

Backed by ADB's AAA credit rating and working with more than 250 partner banks, TSCFP enables trade and supply chains with loans and guarantees that underpin economic growth and create jobs to improve people’s lives. TSCFP initiatives help make global trade and supply chains green, resilient, inclusive, transparent, and socially responsible.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

Source: ADB

Ben&Ben delivers a love song that is unapologetically bare in its messaging On “Dear”

After bagging five wins including Album of the Year at the recently concluded Awit Awards 2022, Ben&Ben returns with a new single that captures the essence of romantic love without forcing or expecting anything in return.

Setting itself apart from the conventional themes often associated with the subject, the nine-piece band encapsulates love that is earned through perfect timing and experience.

On "Dear," Ben&Ben interprets a love song that is unapologetically bare in its messaging.

"We think it's equally important to drop any notion of wanting to deliberately steer clear of potential sounds and themes we may have already done when being unapologetic and honest in songwriting and arranging," the folk-pop collective says in a statement. "Like in love, the more you fight the feeling, the more one might feel internally dissonant."

Penned by Paolo Benjamin and Miguel Benjamin, "Dear" serves as a reflection of the band’s collective and individual experiences with love so far and how one becomes stronger after going through bittersweet lessons in life. The song was recorded at A.R. Rahman's Firdaus Studio during their time at Expo 2020 Dubai.

"Dear is a song that tries to capture the feeling of a deeper kind of romantic love; one that begins when a person surrenders the pursuit of a lover itself to a higher power," reveals Ben&Ben.

From a production standpoint, "Dear" evokes the timeless feeling of nostalgia and earnestness, while capturing the sound of a generation drawn into ‘70s singer-songwriter calm and pop-rock vigor.

"Not only were we able to use their world class studio space and equipment, but we also had the pleasure of working with the stellar team at Firdaus Studio, including Peter El Khoury, Alexander Theux, Theodore Danso, and Ali Hassan," says the multi-award-winning band. "Unlike most of our tracks that we record individually in the studio, we decided to record this one together as a full band, and we feel the final track really reflects that more ‘old-school’ feeling of looseness and authenticity."

Ben&Ben hopes that music fans will connect instantly with the song and get a very valid answer to the question, "How do I know when I’m sure about somebody?" As the Paninindigan Kita act puts it, "We also just really hope this song connects people together in a way that they remember the people in their lives whom they can really call ‘Dear’ as well."

Ben&Ben’s "Dear" is out now on all digital music platforms worldwide via Sony Music Entertainment.Watch the recorded live version here.

Source: Nyou

Cherise Katriel, Cola Cabalcar and Alyn pull weight on the essence of Christmas with jointsingle “Pinakapasko”

Christmas songs have held a unique place in people’s hearts—thanks to its inherent capacity to promote goodwill and generosity without expecting anything in return.

New recording artists Cherise Katriel, Cola Cabalcar and Alyn understand the assignment and deliver a slice of holiday-themed soul with the release of “Pinakapasko,” a new collaborative track under WATERWALK Records and Sony Music Entertainment.

Exquisitely arranged with girl group harmonies and delicate production, “Pinakapasko” reassures comfort in remembering. According to Cola Cabalcar, the song steers us back to the real reason why the world continues to celebrate the yuletide season annually, and why it’s considered the best gift of all.

“Christmas was meant for celebrating the birth of the Messiah,” says the soul/pop rookie. “To quote our mentor and resident composer Jungee Marcelo, it’s supposed to encapsulate the very essence of God’s plan of salvation via the birth of Jesus, the Messiah. The ultimate Christmas celebration may very well be this: acknowledging and accepting Jesus’ wonderful gift of love.”

Capturing the essence of the Christmas celebration, Marcelo wrote and produced “Pinakapasko” as a way to give thanks to the celebrator and celebrant. More than its life-affirming message, Marcelo brought a contemporary spin to the tradition of making Christmas songs, giving the trio a splash of sunshine, and some wings to take it somewhere else ethereal and vibrant.

Cherise Katriel, in particular, praised the material for its masterful blend of jazzy, R&B rhythms and timeless pop hooks, but repeatedly emphasized that at the core of the extraneous beauty lies the power that its words hold. “It's not a typical Christmas song you're used to hearing,” describes the new artist. “Most people are easily hooked to songs that have a catchy beat or tune, and that is what this song has. But that's just a bonus: when you listen carefully to the lyrics, it will bless you even more.”

Alyn Magadia, another music act responsible for interpreting the song with emotional candidness and restraint, considers the experience as a milestone for her as an artist, and a servant of God.

“God-willing, I would love to release more original songs or do collaborations with other talented artists, and more performances live only for His glory,” shares Magadia. “I believe that this is one of my purposes — to bless the people with my talent and to showcase the gift He bestowed upon me.”

For more updates on the new tracks, artists, and upcoming events, please follow:

WATERWALK RECORDS: Facebook | Instagram

Listen to Cherise Katriel, Cola Cabalcar and Alyn’s“Pinakapasko” here.

Source: Nyou

Israel Shares Innovative Solutions for PH Water Challenges

Israeli Ambassador Ilan Fluss presents Israeli innovation and technology to address the Philippines’ water challenges.

The Embassy of Israel in the Philippines through MASHAV – Israel’s Agency for International Development Cooperation and the United States Agency for International Aid (USAID) through the Safe Water held a Water Security Strategies seminar to share with the government and water concessionaires in the Philippines the expertise and experience of Israel on water resource management.

“Israel invested in technology to support the growing demand and urbanization in the country. The technologies were introduced together with good policies and regulations that made Israel the leading country in the world in managing the water sector. From desalination to reuse of sewage, minimum loss of water and more,” Israeli Ambassador Ilan Fluss shared. “Through this seminar, we hope that the Philippines’ key implementing agencies will gain insights from the Israeli experience and adapt them to local conditions,” he added. Like all countries in the region, Israel faced a variety of challenges in the water sector. The Middle East is a dry area and more than 50% of Israel is actually desert.

Director Susan Abano of National Water Resources Board (NWRB) shared the challenges of the Philippines as water availability continues to fall as demand expands. Engr. Rodel Rik Tumanda of Maynilad, Engr. Jon Michael Esteban of Manila Water, and MWSS Chief Regulator Patrick Ty presented their perspectives on managing water scarcity in the Philippines. These were analyzed by the Israeli water delegation and presented advanced solutions to better manage the water sector of the country.

The Israeli companies highlighted Israel’s innovation and technology to inspire and encourage the Philippine water sector, businesses, and LGUs to invest in technologies that will help manage water sustainably. Among the Israeli companies who presented their water technologies were ARAD Group, Atlantium, Okiana, and Watergen. This water delegation offers cutting-edge Israeli technologies in the areas of advanced metering infrastructure, water and wastewater management and treatment solutions, water control solutions, and turnkey projects.

Around 50 officials from the Philippine national government agencies, local government units, private sector, and academe attended the seminar on November 17. Notable government officials who participated were Usec. JV Llamas of DILG, Asec. Roderick Planta of NEDA, Atty. Patrick Ty of MWSS, and Mayor Glenn Flores of Alaminos, Laguna. Also in attendance was Mr. Rene Meily, President of PDRF.

Source: Embassy of Israel in the Philippines

Space-Ta hosts a listening party for the release of his retro-futuristic album, Flight of the White Rekusasu

Electronic avant-pop artist Space-Ta threw a listening party at Whitespace Manila on November 18, 2022 to celebrate the upcoming release of his full-length debut album, Flight of the White Rekusasu.

Incorporating genre-blurring soundscapes with intricatebeats and retro-futurist production, Space-Ta’s 8-track record blasted through the speakers as the audience enjoyed free-flowing cocktails and drinks against a backdrop of minimalist, underground club scene.

DJ acts Baby Oliv and Red-i complemented the mood of the event with banger-after-banger jams that evoke after-hour rumination in a retro-futuristic set.

A voiceover that hints about the concept behind Space-Ta’s new album, was also played during one of the segments of the program. “In a world where the TIME COUNCIL has countlessly reformatted life as we know it, Space-Ta journeys back in time to explore extinct music genres and bring them back to the planet with the cinematic beauty that they once had,” introduced the VO. “An enigmatic figure in the 2032 music scene, he opposes norms, defends freedom restricted by the powers-that-be, and rediscovers himself as an artist poised to transform the world.”

Flight of the White Rekusasu will be available on digital platforms worldwide on November 25, 2022. The album is set to be released under Lockdown Entertainment—home to several critically acclaimed artists in the Philippines such as Tarsius, Flying Ipis, Assembly Generals, and more.

Space-Ta: About The Artist

An elusive figure in the music scene, Space-Ta is a time traveler-philanthropist-musician that lives in the year 2032. From a world where the TIME COUNCIL have countlessly reformatted life as we know it, S-T moves back and forth in time to re-establish and reconnect erased music genres that were banned by the TC.

Like graffiti rivals, S-T re-establishes the undone music by collaborating with past musicians to bring back what was lost while simultaneously rediscovering himself in the process.

Space-Ta’s story is continually told through music, animation, and various forms of media- all of which are given to his listeners in small doses and through fleeting experiences.

Source: GNN

QCPL

My latest books under @ukiyotopublishinghouse and my books #speakbloglive and #speakwritelive under @centralbooksph @publishondemand are now at the Quezon City Public Library! Special thanks to Ms. Cherry Taruc and the Collection Development Team for having me. 📚 Please continue supporting me by purchasing my books on Amazon, Google Play, and https://linktr.ee/speakoutsam 🇵🇭 NEVER GIVE UP ON YOUR DREAMS!📚 #amazonauthor #authorlife

ALAN WALKER RELEASES SECOND PART OFHIS ‘WALKERVERSE’ ALBUM UNVEILS SECOND COLLABORATION WITH AIRINUM

With just over a month left of 2022, Alan Walker is preparing to take his fans further into theWalkerverse, with the second part of thehomonously titled album – out now via Sony Music.

Wasting no time, Walker opens up with standouttrack ‘Shut Up’. Enlisting the vocals of American Indie singer/songwriter UPSAHL, ‘Shut Up’ fuses Alan’s progressive house sound with UPSAHL’slarger-than-life vocals for an impossibly catchytune that is nothing short of anthemic. Next up a track that was released to celebrate the beginning of his Tour, ‘Extremes’ ft. Trevor Daniel is an alternative pop meets trap soundscape with a little added grit. Dropped as a surprise release at the beginning of the month, ‘Lovesick’ ft.Sophie Simmons is an intoxicating single featuringa huge orchestral soundscape, that, as the lyrics suggest, has all the features of an electro lullaby. Closing out the EP with ‘Catch Me If You Can’, Alan creates a playful production, masterfullyexperimenting with staccato sounds and vocalsfor a cat and mouse style effect that echo’s the song’s title.

Earning global superstardom as the masked producer, Alan has once again teamed up withleading Swedish health tech brand Airinum for anexclusive collaboration that will provide his fans with the most advanced air mask on the market. Launched on 15th November, the second collection is comprised of four styles, with this year’s collaboration mask also part of his official stage outfit and available for fans on the official merchandise store.

“Wearing a mask has been a part of my identityfor a long-time, and of course, most recently we all learned the health benefits of face coverings. I am so happy to be teaming up with Airinum toshare my designs once again, and createsomething that not only looks cool but also helps to protect us” Alan Walker.

Source: Sony Music Philippines

Ace Banzuelo explores grief and romantic disintegration on his new song “Kulang”

The 22-year-old Filipino singer-songwriter/producer builds on the success of “Muli” with another unabashedly vulnerable, alt-pop anthem

2022 has been a stellar year for Filipino singer-songwriter/producer Ace Banzuelo with his emotional single "Muli" breaking through the mainstream pop consciousness two years after it was released—thanks to its relatable lyrics and vibey, electro-ballad sound. After trending significantly on TikTok, the song launched Banzuelo into the spotlight, unmovable at the top of the Spotify Philippines and YouTube Philippines Trending charts for an extended period of time.

Fast forward to November 2022: Banzuelo continues to build on the success of "Muli" with the release of "Kulang," an unabashedly vulnerable track with trap, R&B, and bedroom pop influences. Decked in retro-futurist synthesizers and laid-back, hip-hop beats, "Kulang" finds the 22-year-old multi-hyphenate aimlessly writhing over heartbreak in his quiet, subdued time, wallowing in loss or lack of personal direction.

According to the Himala artist, "Kulang" examines a stage of grief where you find out that you have been wronged but still try to make things work. He goes on to say, "The story is inspired by a time in my life when I was questioning myself about where I went wrong, and where I lacked. Whatever I’d do, it was just the same thing all over again. You’re aware that you’re in this drama, and you keep coming back to it, but you just want it to stop."

In true Banzuelo songwriting style, "Kulang" belongs to the crop of tunes that depict heartbreak, grief, and relationship fallout in their most vulnerable state, be it confessional or observational. "I’m here to talk about things most people are afraid to let out," the young hitmaker adds. "I’m not often sad, it’s just the mood of my music right now, and I think the beat and production style speak for themselves."

He also recorded, produced, performed, and engineered the entirety of "Kulang," but what distinguishes it is Banzuelo’s effortless ability to wrap melancholy in incredibly catchy packaging. To make it special, he also adds a rap verse in the middle of the song. "I kind of collaborated with that side of me. Being a hip-hop head myself, I’ve always wanted to experiment with performing songs in a certain way. I'm not a rapper yet, but this is a much-welcomed reprieve from the usual."

Ace Banzuelo’s "Kulang" is out now on all digital music platforms worldwide via Sony Music Entertainment. Listen to the song here.

Source: Nyou

Singapore-based artist Naomi G releases brooding alt-R&B track “Delirium”

Singaporean experimental pop artist Naomi G has finally released “Delirium,” the titular track off her upcoming album to be released soon.

A love letter to her partner, who has ongoing bouts with dissociative disorder, Naomi G deep-dives into the complexities of love and mental health on this brooding alt-R&B banger. The lingering familiarity of an electric guitar, complemented by syrupy synths, underpins the tune with an etherealness reminiscent of the oscillation between dreams and reality.

Naomi G's vocals cut through the cloud of dissociative ambivalence, adding a dimension of soul and charisma to the track. She sings over and over, "Baby, you're in delirium" to bring her partner back to reality, and her message is one of compassion, love, and understanding.

No stranger to approaching complicated themes with confessional poignancy, Naomi G’s previous tracks have dealt with personal issues that raise a middle finger to male toxicity and emotional abuse. Now that she's moved on to a new chapter of her life, Naomi G's "Delirium" and the album that it will be part of, unearth stories that directly address her personal experiences and struggles with mental health, while trying to break the mold shaped by the powers-that-be and the men who used to play an important role in her life.

This first track, "Delirium," seeks to express the minutiae of a relationship touched by psychological obscurities, as many surely have been. The eloquently produced piece subtly transitions to a conclusion with the understated keys of delicate jazz, easing itself into a space of solace. It’s as though Naomi G has taken the intended recipient by hand, holding him steady, as her final line reverberates, "I’mma walk you through."

“Delirium” is out now on all major music platforms, with the music video dropping on the 25th November 2022. ‘Delirium’ will be the first of 8 album tracks slated for gradual release in 2023.

Listen to ‘Delirium’ Here (Pre-save link)

Source: Nyou

Hazel Faith reinvents Christmas songs with technicolored glow in new bop “Pasko Kasama Mo”

Filipina songstress Hazel Faith spreads the joy of the Yuletide season with the release of her upbeat Christmas tune “Pasko Kasama Mo” via WATERWALK RECORDS and Sony Music Entertainment.

Revisiting the holiday experience with technicolored bounce, funky chords, and ‘80s city pop lilt, “Pasko Kasama Mo” finds the rising phenom bringing back the gilded memories of Christmas while reminding listeners why it’s the best time of the year.

“My mother has been asking me to write Christmas songs since forever,” says the multi-talented act. “But I had a hard time writing my own because I felt like all the great Christmas messages had already been made. For that reason, and the truth that I only saw Christmas as a tradition, left me uninspired. But after the Lord renewed my faith, it's like my vision turned technicolor. Suddenly, I was excited to celebrate Christmas. Not because of the parties, the foods, or the gifts but because I was finally looking at the One whom Christmas is all about. Truly Christmas felt hollow without Christ himself. And that led me to writing Pasko Kasama Mo. This was finally something I had a unique perspective to.”

The track was written by Hazel Faith herself, and was arranged, produced, mixed, and mastered by Albert Tamayo, a good friend of the gospel-pop sensation. Faith, in particular, felt eternally grateful to Tamayo for being part of her music journey and lending his talent to the project.

“It's a joy for me to be able to showcase his genius in Pasko Kasama Mo as well,” adds Hazel Faith. “When it came to the vibe, it was probably influenced by my feeling of nostalgia and then looking forward to all that is new. But honestly, I just told kuya Albert to make it sound like a station ID.”

With guidance by award-winning composer Jungee Marcelo and a rap verse by WATERWALK RECORDS’ very own Jericho Arceo, “Pasko Kasama Mo” captures the spirit and glow of Christmas with a retro-modern appeal. It’s a bop that echoes the feel-good comfort of a home, bursting with so much life, energy, and natural charisma.

For more updates on the new tracks, artists, and upcoming events, please follow:

WATERWALK RECORDS: Facebook | Instagram

Listen to Hazel Faith’s “Pasko Kasama Mo” here.

Source: Nyou

RAUW ALEJANDRO’S ‘SATURNO’ Is Here to Forever Change Urbano

MIAMI (November 11th, 2022) - In today’s fast-paced release environment, it’s almost unheard of for an album to be more than just a collection of songs meant to fuel playlists and dancefloors. But for Saturno, Rauw Alejandro wanted to elevate the affair by crafting a true album experience–one that’s meant to be enjoyed from beginning to end.

“I wanted to take my fans on a ride through my mind, my emotions–the sounds that influenced me,” says the Puerto Ricans singer and songwriter. “This album tells a story from beginning to end.”

Right from the intro, the otherworldly sounds blend with stunning homages to hip-hop’s earliest pioneers–taking you back to the block parties in the Bronx. “For me this album is a collection of the sounds that shaped me. From early hip-hop, to freestyle, and of course reggaeton, these are the elements that make me who I am,” says Rauw.

Aside from continuously expanding the soundscapes that traditionally fit within the genre known as urbano, Rauw has even taken more of a hands-on role in producing this expertly curated offering, serving as co-producer on

18 of the album’s 18 numbers–ensuring his exact vision comes to life.

Even the name of the album has deep meaning for him. When Alejandro was growing up, his mother would often tell him he was from another planet. “I believed my mom, because I knew I was destined for something out of this world. That’s why I named the album Saturno,” says Rauw of his third album.

With Saturno’s already-successful singles like “Punto 40” Feat. Baby Rasta, “Lokera,” and “Dime Quién????” blowing up the charts, you can expect a steady stream of bops and bangers to flow from this album at a supersonic pace.

An otherworldly experience like this doesn’t come often. So, sit back, strap in, and let El Zorro take you on a trek to perreo’s most distant cosmos.

Since the release of his first album, Afrodisíaco in 2020, Rauw has reached multiple accolades, including gold certifications, GRAMMY® nominations, and literally billions of streams. With Saturno’s release, Rauw will soon embark on a worldwide tour which will bring his eclectic sound to the masses.

Sigue a Rauw Alejandro en // Follow Rauw Alejandro on:

www.instagram.com/rauwalejandro/

www.twitter.com/rauwalejandro/

www.facebook.com/rauwalejandro/

www.youtube.com/rauwalejandroTV/

Source: Sony Music Philippines

My Books at the National Library

My internationally-published books, #ibefriendedmyself, #breakingupforward, and #boundariesforthebetter, are now at the National Library of the Philippines! 🇵🇭 It is an honor to have my books in the same building as the original #nolimetangere by Jose Rizal 🥹 You may support me and my work by purchasing my books on Amazon, Google Play, and https://linktr.ee/speakoutsam 📚 NEVER GIVE UP ON YOUR DREAMS!⚡️ @ukiyotopublishinghouse #authorlife #amazonauthor

ASEAN-India Music Festival 2022 to highlight university-centered music programs before and after main festival at Purana Qila, Delhi

The pre- and post-festival music programs will take place at Ashoka University, Government schools in association with the Global Music Institute and North-Eastern Hill University in Shillong

ASEAN India Music Festival (AIMF) returns this year with extensive music programs to be held at some of India’s premier universities. The three concerts will be part of the 30th-anniversary celebrations of the ASEAN-India Dialogue Relations.

Multi-genre contemporary acts from several ASEAN countries and India will be performing at three concerts which will be held at Ashoka University, Government schools in association with Global Music Institute and North-Eastern Hill University (NEHU) in Shillong. Similar to AIMF—which will take place from the 18th to 20th of November at Purana Qila, New Delhi—the concerts and workshops will be free of charge.

Serving as a prelude to the main festival event, the Ashoka University concert will take place on November 17, 2022, 7:00 PM onwards and will showcase music from Tri Minh’s Quartet (Vietnam), Instamuzika (Malaysia), RizerXSuffer (Cambodia), and Empty Wallet (Brunei Darussalam).

ASEAN India Music Festival’s closing ceremony will be hosted on November 20, with Minister of External Affairs Hon'ble Dr S. Jaishankar as chief guest.

On November 21, a lecture demonstration and workshop will be given at a Government school in association with the Global Music Institute in Delhi. Guests will also be treated to demonstrative performances from Lao Traditional Music Troupe (Lao-PDR), Makaohang (Thailand), and Bayang Barrios at Ang Nilayagan (Philippines).

Finally, wrapping up this year’s series of music festivities is the Shillong leg of the ASEAN-India Music Festival on November 22 at North-Eastern Hill University in Meghalaya, which aims to increase the students and youths’ awareness and celebration of music from the ASEAN region, which in turn help propel interaction and tourism between India and ASEAN.

The concert will feature performances from Shillong’s very own Colours, MRTV Modern Music band (Myanmar), Riau Rhythm (Indonesia), and Linying Band (Singapore). The concert starts at 5:30 PM.

“It is very rare that there is such a vast representation of music from Asean region where India has a lot of commonality in our shared cultural histories and traditions. Therefore it is only natural that the youth and the young generation of India should get to hear and have direct interaction with these musicians rarely seen and heard in India,” Sanjeev Bhargava, Director of ASEAN-India Music Festival 2022, shares. “These workshops and interactive sessions will go a long way in spreading awareness of common musical traditions between ASEAN and India."

The university concerts and lecture-workshop program are organized by the Ministry of External Affairs, Government of India in collaboration with SEHER, who are also the main organizers of the second edition of the ASEAN-India Music Festival 2022.

Source: Nyou

Boundaries for the Better Paperback

I am happy to announce that my 12th book, #boundariesforthebetter, is now available on paperback in the Philippines! Buy it on @ukiyotopublishinghouse’s website or via this link: https://linktr.ee/speakoutsam NEVER GIVE UP ON YOUR DREAMS!#authorlife #amazonauthor

Boundaries for the Better

My 12th book, #boundariesforthebetter, is out now worldwide on Amazon and Google Play! I wrote this to help you navigate through our changing times with essential boundaries in place for your own well-being. Buy it today https://linktr.ee/speakoutsam #authorlife #amazonauthor @ukiyotopublishinghouse

ADB and Indonesia Partners Sign Landmark MOU on Early Retirement Plan for First Coal Power Plant Under Energy Transition Mechanism

BALI, INDONESIA (14 November 2022) — The Asian Development Bank (ADB) today joined with key partners in Indonesia to sign a memorandum of understanding (MOU) to jointly explore the early retirement of the first coal-fired power plant owned by an independent power producer (IPP) under ADB’s Energy Transition Mechanism (ETM).

The signing, which took place on the sidelines of the G20 Leaders’ Summit in Bali, was attended by ADB President Masatsugu Asakawa, Cirebon Electric Power (CEP) President Director Hisahiro Takeuchi, PT PLN (Persero) President Director Darmawan Prasodjo, and Indonesian Investment Authority (INA) CEO Ridha D. M. Wirakusumah.

The MOU agrees to open detailed discussions to accelerate the retirement of Cirebon-1, a 660-megawatt plant owned by CEP in West Java.

The planned transaction aims to achieve significant carbon dioxide emission reductions through a replicable model that can be applied to other IPPs in Indonesia, other parts of Asia and the Pacific, and beyond. Once a definitive agreement is reached among the parties, it is anticipated that ADB would provide an early retirement facility in the form of senior debt, on the condition that the tenor of the power purchase agreement between CEP and PLN will be shortened.

“This MOU with our trusted partners in Indonesia is a landmark moment for ADB’s Energy Transition Mechanism and the clean energy transition it will advance,” said Mr. Asakawa. “As Asia and the Pacific’s climate bank, ADB is proud to be showing the viability of this approach, supported by the outstanding leadership of Indonesia. We encourage other financial stakeholders to engage in the just and affordable energy transition here and across Asia and the Pacific."

"ETM provides an innovative approach for companies like CEP to make the transition from coal to clean energy while providing reliable and affordable power for Indonesia’s energy infrastructure," said Mr. Takeuchi. “This MOU is a big step forward for Indonesia and we are proud to be working with the Asian Development Bank and Indonesian Investment Authority.”

"PLN is committed to being a leader in Indonesia’s energy transition toward net zero emissions in a just and affordable manner," said Mr. Prasodjo. "PLN’s commitment to clean energy and working through the ETM with IPPs, such as CEP, can significantly accelerate the energy transition."

“INA’s role is to help attain Indonesia’s sustainable development and to build wealth for the country’s future generations,” said Mr. Wirakusumah. “The ability of INA to complement the other partners with equity can complete the suite of financial tools that can help to scale up ETM activities in Indonesia.”

ETM is a regional, transformative, blended-finance program that seeks to retire existing coal-fired power plants on an accelerated schedule and replace them with clean power capacity. ETM is one component of a larger set of initiatives both domestic and multilateral, that aims to help Asia and the Pacific mitigate the worst impacts of climate change, such as extreme sea level rise and destructive weather events.

The MOU was signed at an event in which Indonesia launched its ETM Country Platform, a government financing and investment framework that will fund and manage the country’s energy transition activities. ADB signed an additional MOU with PT Sarana Multi Infrastruktur (Persero) (“PT SMI”) to provide support, including staff resources and capacity building for the platform.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

Source: ADB